Paidoff™

Homeowner’s Much Faster Loan

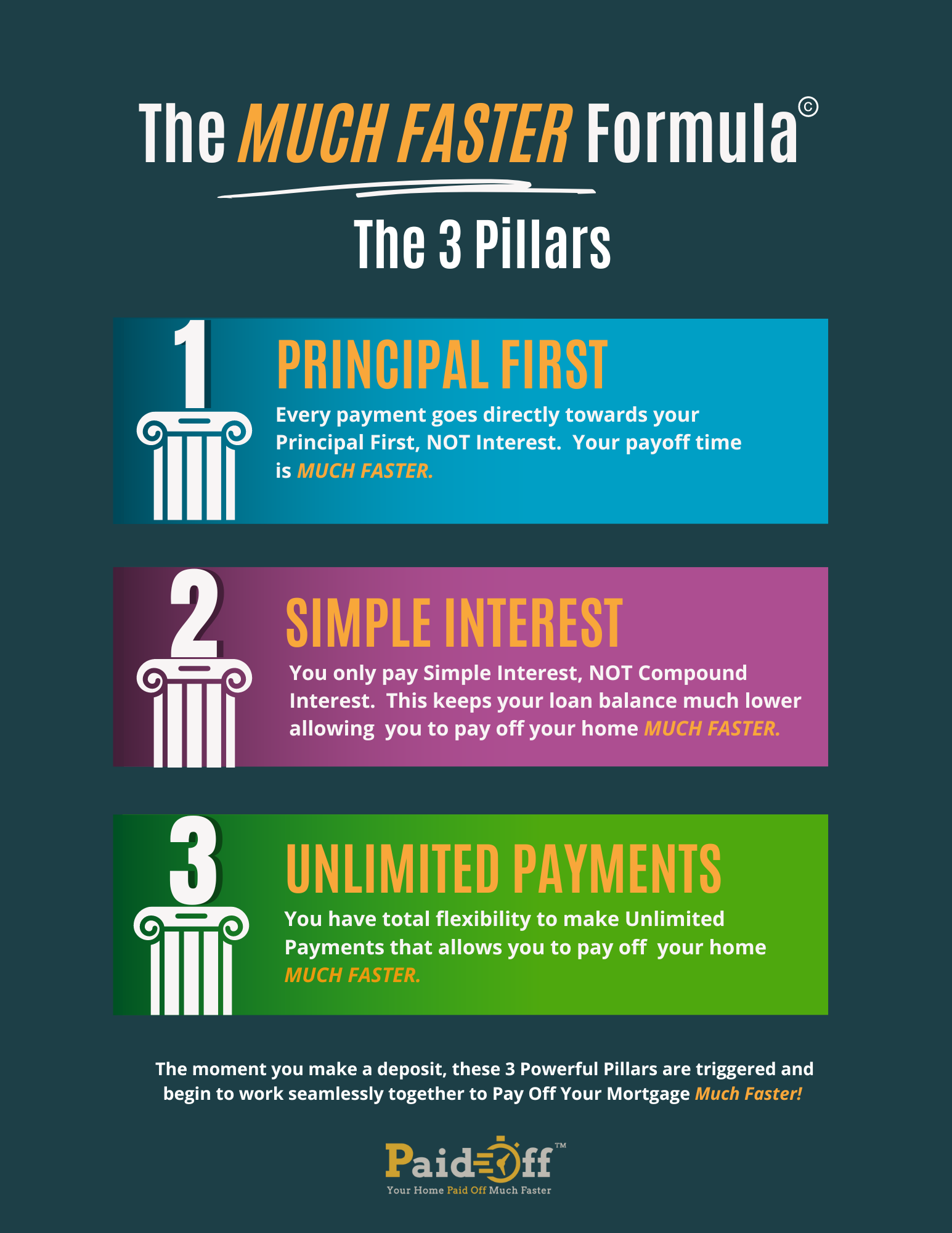

Paidoff™ allows you to pay off your home Much Faster than a Traditional Mortgage. Most of our homeowners pay their homes off under 5 years without changing lifestyle. All your mortgage payments go straight to the Principal first, not Interest. You only pay Simple Interest, not Compound Interest. You also have complete control and freedom to pay as often as you would like.

The snowball effect allows you to pay off your mortgage super-fast, saving hundreds of thousands on interest.

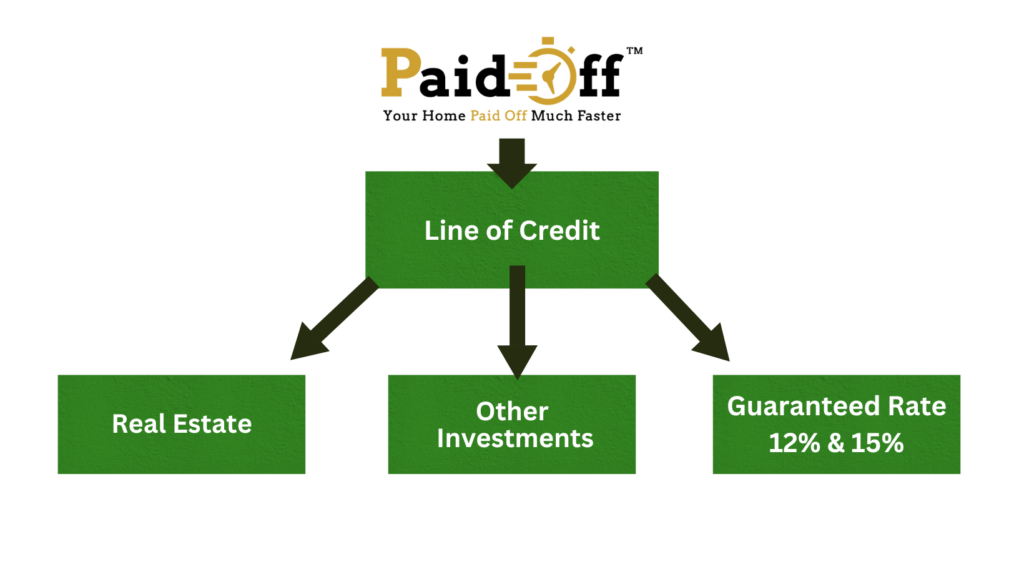

As a huge bonus, you get an automatic Line of Credit, which allows you to grow your wealth exponentially.

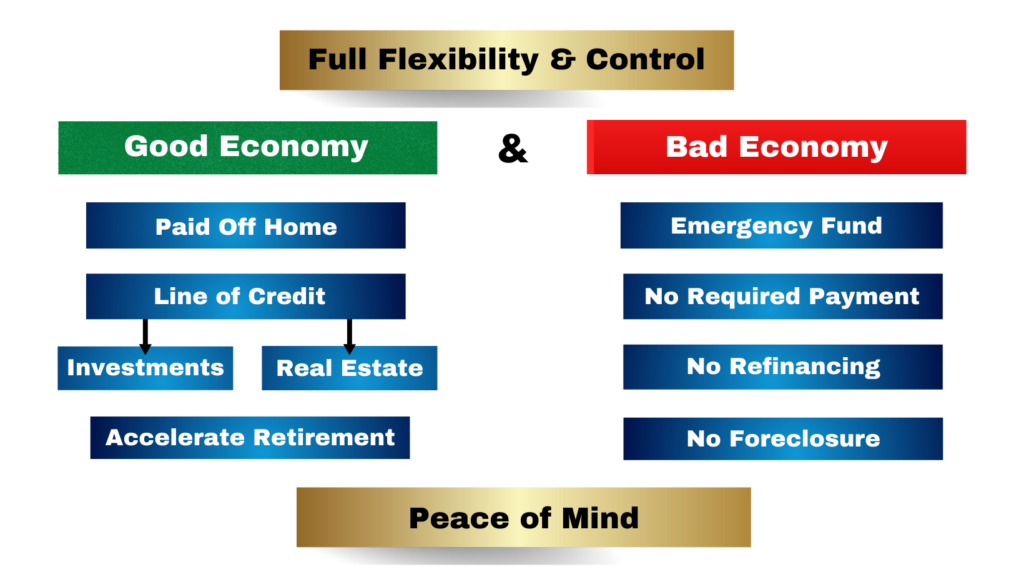

Paidoff™ works in Any Economy

The great thing about Paidoff™ is regardless of the economy or what happens in your life,

you are in complete control and have the flexibility to deal with it without all the stress and feeling hopeless.

Compare How the Mortgage Balance Drops

Paidoff™ vs Traditional Mortgage

On average, our clients usually pay their homes off in under five years.

The Paidoff™ Much Faster Formula™ shows how this is possible.

With Paidoff™, Interest Rate Does NOT Matter.

The speed and loan balance matter because 100% of your money goes to the Principal, not the Interest. In addition, only Simple Interest is assessed, not Compound, and there is no limit on how often you want to pay. This powerful combination allows your balance to drop Much Faster, leaving your interest rate behind. Click here to read about how Irina beat the banking system, paid off her home in 1.5 years, and how you can also pay off your home Much Faster.

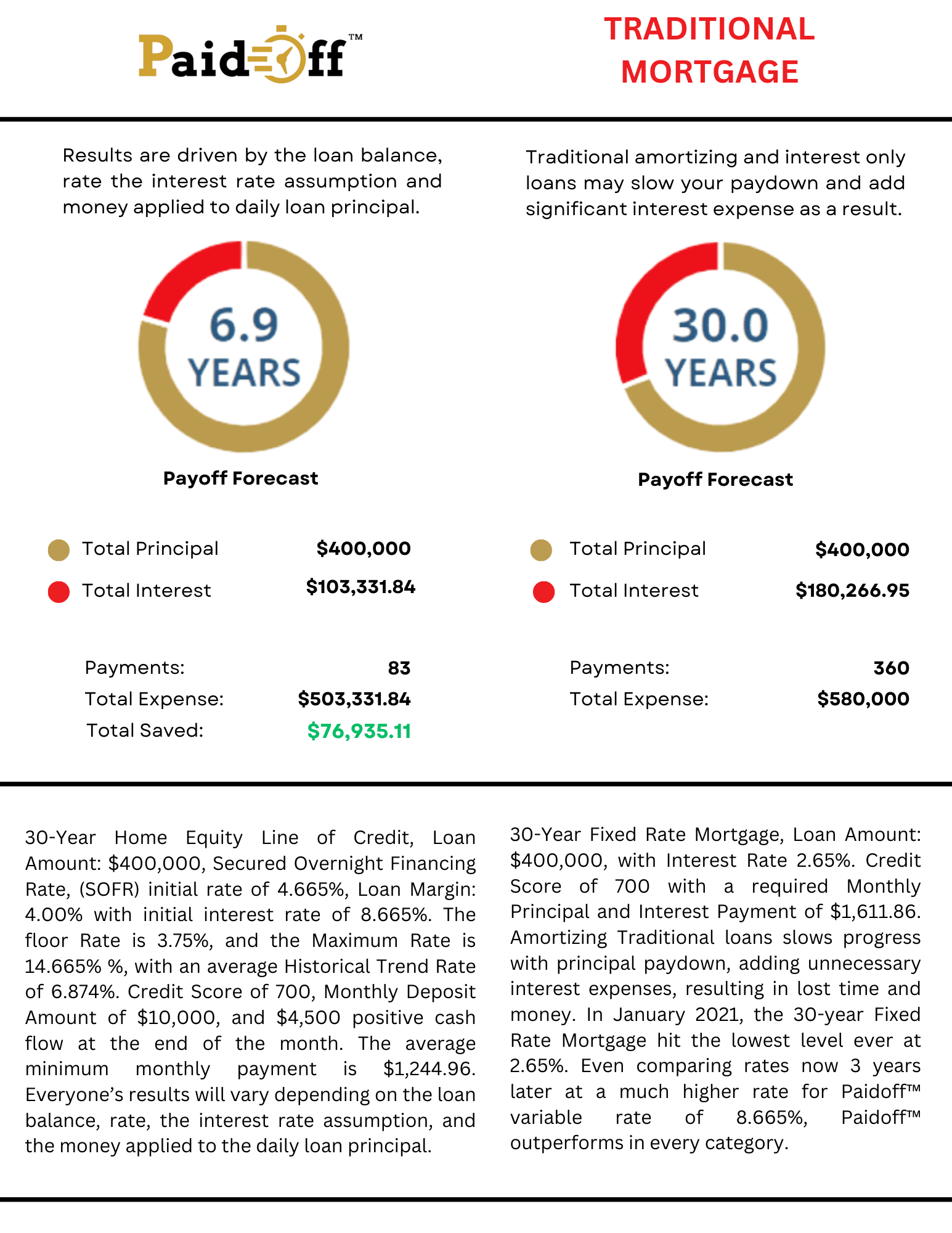

How Paidoff™ Outperforms the Traditional Loan

at even the Lowest Rate Ever, 2.65%

Paidoff™ Comparison Loan’s Effective Annual Percentage Rate, APR, is 1.592 % compared to 2.65% with Traditional. The APR is the actual true cost of the loan. Not only did the lower interest rate Traditional mortgage cost $76,935.11 more in interest cost than

Paidoff™ Comparison Loan’s Effective Annual Percentage Rate, APR, is 1.592 % compared to 2.65% with Traditional. The APR is the actual true cost of the loan. Not only did the lower interest rate Traditional mortgage cost $76,935.11 more in interest cost than

Paidoff™, but the homeowner would need a 30-year Fixed-Rate Mortgage at 1.592 % to beat Paidoff™. This rate has never existed and probably never will! Besides accomplishing all this, please do not forget you shaved 23.1 years off your 30-year fixed-rate mortgage.

When you schedule a Free Consultation with us, we will run your numbers to see if Paidoff™ is right for you. You will also receive a 6-page loan comparison to make an informed decision.

Paidoff™ Drastically Outperforms the Traditional Loan

when rates are higher, 7.00%

Paidoff™ Comparison Loan’s Effective Annual Percentage Rate, APR, is 1.347 % compared to 7% with Traditional. The APR is the actual cost of the loan. Not only did the lower interest rate Traditional mortgage cost $471,591.85o more in interest cost than Paidoff™, but the homeowner would need a 30-year Fixed-Rate Mortgage at 1.347 % to beat Paidoff™. This rate has never existed and probably never will! Besides accomplishing all this, please do not forget you shaved 24.2 years off your 30-year fixed-rate mortgage.

These comparisons validate that the Interest Rate Does NOT Matter with Paidoff™ and Paidoff™ clients Pay Off their Home Much Faster by over 23 years and Win Financially in Every Way!

Paidoff™ 30-Year Line of Credit

Automatic Wealth Accumulation Success

Paidoff™ gives you many financial possibilities. It is the only loan that offers you complete control of your money, not your bank. The extensive Line of Credit is a significant opportunity to grow your wealth. You can use it as an Emergency Fund, purchase investment properties to rent out, and create passive income. You can invest your funds in any way you desire, with your financial planner and/or with our partner, at a 12% or 15% Guaranteed Rate of return. The possibilities are endless.